The 2015 China Coal Coke Steel Industry Conference, jointly sponsored by China Coal Industry Association, China Iron and Steel Industry Association, China Coking Industry Association and Dalian Commodity Exchange, and exclusively organized by Shanghai Steel Union, was held in Hangzhou from August 19th to 21st. The conference was based on the theme of “Integration of Industry and Finance and Assistance for Industry Upgradeâ€. Sina Finance is the exclusive portal strategic partner to broadcast the entire conference. The following is a record of Gao Bo, the general manager of Shanghai Ganglian E-Commerce Co., Ltd. Gao Bo: Good afternoon everyone! Let me talk about the situation of ferrous metals. I have not participated in the coal coke steel conference before. This is the first time. I am trying to talk about steel and iron ore. First of all, let me talk about the feeling of attending this meeting. The new wave of fights in the overseas derivatives market may have begun. It also means that the situation behind the iron ore domestic joint trade is more complicated, because opening the door is not just for us. Going out and putting a lot of masters in, so the back panel will be more complicated. But I think this will greatly promote a lot of transactions, and the spread trading between the two sides will be more active, which is a good thing. In addition, when Mr. Wang said in the morning, we saw cross-border settlement. The central bank has issued documents. In addition to crude oil and iron ore, this may be the future trend. The fusion of domestic and foreign derivatives is a trend in the future. This is a good thing. Second, this year's pessimism is not very positive. The whole meeting is full of positive energy. Although the leadership speech is more cautious, we still hear positive energy. Third, the market has reached a more complicated crossroads. This sign is that the big men are afraid to come out and make a directional speech to the market, and they must respect the market. Fourth, I feel that the integration of financial derivatives and the spot market may be a big new point in the future market. We also see that for companies that combine this model, everyone's production status is significantly better than the survival of companies that do derivatives. In the morning, the leaders talked about the positive energy in the market. In the afternoon, many leaders also talked about the business model. We still have to comment on the market. First of all, this year's market is a symbolic year, all varieties are out, and in 1997 we have some price records. (PPT diagram) These are price indices. Our prices cannot be compared with the prices before 2003, because the currency is not the same, and new machines have emerged. Since the price record, compared with the current price, it was 20 dollars 15 years ago and 16 dollars and 17 dollars 17 years ago. This is basically the case. The strategic angle here is different. The leaders of the coal industry hope that the coal enterprises will live a good life. The iron ore industry also hopes that the iron ore enterprises will have a good life. Some information about the current situation. From my personal point of view, we may not be unified about personal market, but the data is unified, and the conclusions based on the data are not uniform. At the beginning of the stage, when the iron ore fell, the bottom of the first wave was already explored. The stock market formed a pre-judgment that may have a financial crisis, and it also superimposed the continuous plunge of the entire financial market. Throughout the process, The bottom of the shot is a very standard FMG cost line. Is it possible to break behind this line? This needs to be split out to look at the various factors. After all the factors are arranged, I think the main contradiction in the market has these aspects: First, the demand looks very bad. From the perspective of the aging population, the consumption intensity of steel It is declining. We also see that the apparent consumption and output of the whole steel have changed. This is a trend change. In terms of the arc top, consumption is not only strong, but also in front of August. In a week, the consumption of cars is also picking up, the price of real estate has not gone down, and the shrinking of the whole consumption has declined at least in many fields. This is an indisputable fact, so consumer demand does not seem very good. Then we are faced with the problem of manufacturing capacity, which has not been effectively solved. Capacity is the biggest contradiction in the formation of the entire black industry chain. If the final capacity cannot be eaten, then the iron ore will be in the current position for a long time. We have to fight all the wars around FMG, although we can see that Zhuang said In the bottom of the cost floor, but we know that his average cost is the two average concept, Vale's cost distribution optimization and FMD cost optimization, Vale can form the first batch of cost price elimination. Looking at the choices of FMG and Vale, as well as the extent and situation of the distribution, have had some impact on the entire supply market, and we will discuss it after reading it. Here we can look at the previous demand first. First, let us know that we have a production of 93 million tons last year. If we increase it month by month, the annualization may be 130 million tons. Compared with last year, we basically It is an incremental export of 40 million tons. In the building materials, we have made the differentiation of the big snails and the small snails very serious. That is to say, the things that make the foundations are not sold, and the materials directly related to the parts are sold. Regarding the demand situation of real estate operating rate, the sales area of ​​real estate has increased, but the amount of new construction has experienced a double-digit decline, so the differentiation of Dalu and Xiaoluo reflects the macro data. Looking back, the formation of multiple investment, the government now realizes that the Belt and Road has a certain chance of relying on the road, or dragging the time is relatively long, it may be better to come to the real thing, in addition to the government investment-driven mechanical engineering, this Two overlays can block a part of the decline in demand. In addition, from the perspective of the operating rate of the factory, I personally have a lot of reflections recently. There are many points that cannot be explained. The operating rate and the amount of port-opening cannot be combined. The data of the reverse push is larger than the actual operating rate, that is, the factory. The data provided is partially distorted. Everyone knows that there may be many problems when increasing production and reducing production, but whether we are real or not, we are checking. Some time ago, the market operating rate that everyone imagined might not be so low. Second, the terminal demand is not so imaginary. On the other hand, if the operating rate is higher than everyone thinks, then the inventory, including the site inventory and social inventory, is going down, which is in a low inventory. State, here is enough to prove that demand is improving at least in July and August. The influential factors in the middle may be seasonal factors this year. From iron ore to steel, the seasonality of the entire demand has been delayed for more than a month. This may be a problem of market sentiment suppression. In addition, it may be weather-affected. Factors, this season has not been so hot this season, when the heat is also a little worse than now, for Brazil, there will be a strong natural disaster in the first quarter of each year. On the contrary, in the second quarter, many natural disasters were encountered, and the most influential one was Nito. Here, the production capacity is in the middle, and the structure must be that the price of raw materials is stronger than that of steel. Otherwise, the structure of de-capacity cannot be completed. The output in June is now digested. After a wave of bottoming out, we saw that the 1509 contract was pulled from the low position and pulled more than 100 points, indicating that the iron ore is still good, but I did not agree to measure the port inventory method, and we went to compare the two. Port inventory before the year, why can't it compare? We know that starting from July of this year, the port inventory began to bottom out. Here we first explain a problem. We have faced this wave of production increase from the mine in September 2013. The second big problem is The sharp decline in the entire market, along with the sharp decline in prices, accompanied by a lot of iron ore launched into the market. Judging from the data in July, we can see that the exit from overseas is basically over, and the country has launched a part in July. The exit data for July is not yet available. I think this part of the exit flexibility is relatively large, that is to say, part of the exit in July will come back in August and September. As long as it doesn't come, basically many of them will stop coming back, that is to say, the capacity area of ​​the upstream of iron ore will stop. The news report that can be seen this year is that in the last investor relations meeting, the boss of China said that the company earned the overall interest. Here are two aspects. One is that iron ore has fallen to a certain extent, and FMG has declined. Then the bottom will go down. This is not very right. It can't be dropped because the traders in the market are not arbitrarily and will not tell you morality. In terms of Rio Tinto's direction, the direction of their investment is very clear. The first large-scale production of coal production capacity, coal production capacity has no profit, iron ore has profit, and the company's long-term income is obtained through the form of quantity. I think this is a very simple and realistic logical relationship, so at least the strategy of the two extensions is in urgent need of expansion. Many of our analysts said that at the beginning of the year, they were fooled by three major mines. When we analyze the progress of the three major mines to increase production, we must first consider a factor. The three major mines are listed companies. This is for the executive level to talk to investors and the board of directors, not what you listen to. You listen. It’s the goal, but I don’t know if it will form. So people who ask mines, they can't give you a definite reply. From the current point of view, everyone usually resists the past half year, and the increment in the second half of the year should be no big problem. We can look at historical problems. Here are also There may be a problem. We can only calculate from the data of previous years, the situation in the first half of the year is better than the second half. In another case, the shipments we have seen in the second half of the year have increased sharply in the past few weeks. This wave of rebounds is the resumption of steel production. Back to the current position, the two sides are superimposed. From the superposition situation, it is basically good. The front bottom is close to the bottom. The 1606 contract reflects the discovery of the late market. If we look at the futures stage of each stage. If you can't say that the market is wrong, each stage clearly reflects the superposition of sentiment in the spot market and the fundamental changes in all aspects. In fact, it is normal. The deeper the fall, the more likely it is to rebound. It is complementary. From the perspective of airdrops, this is mainly the case. Everyone should be careful about the US interest rate hike. Although there are only 58 prediction possibilities, at least the central bank has already believed and adopted the impact of raising interest rates. Looking forward to the steel market in the third quarter, under the influence of factors such as environmental protection and steady growth, the steel market will show a trend of differentiation, and the long products market is expected to oscillate. Therefore, iron ore is under pressure but not suitable for bearishness. Basically, the iron ore is less than 40 dollars, and the probability of rebound is very strong. In this position, the pressure is also relatively large. As long as the two sides do not produce a large factor, the relative space is relatively clear. . I am more empty, but I am more empty. Why? A very simple truth, as long as the capacity of the steel mills is not concentrated, and the whole market is expected to reverse, rather than rebound, then the country will take 4 trillion yuan to pull the market up. If it is not pulled up, we expect the demand to be stable. It is not very likely that the current market will be pulled back into the multi-investment market, so it is biased to continue to bearish. If you come up, you will be empty, go on, and so on. This is a relatively insurance trading strategy. We should pay more attention to the fact that due to mismatching of resources and capacity, we have created some arbitrage trading opportunities. For example, when capacity has a chance to sorrow in a certain curve, there are still many trading opportunities and also Many people say that our financial attributes are a bit worse, which is a better type of operation than non-ferrous products. This is a headache for us to work in this industry. In addition, we can stand on the side of the observers to see the reasons why the production capacity can not be transformed, and lose so much without reducing production. First of all, the steel industry accounts for a large proportion of GDP in the national economy. If we want to protect the proportion of the steel industry, we can't let the steel collapse. Therefore, the stability of steel can bring many negative effects. Second, if the factory is dumped, the factories in many places are not in the center of the city, but here is a labor-intensive industry. In addition, as long as the factory is open, the local government's financial support will have a certain effect on the local economy and GDP. Fourth, this is a typical game theory. Everyone wants other people to cut production first. I rush to the end is the winner. If local government operators realize this situation, they may also subsidize the enterprise, at least this is the place. The government has a clear logical relationship. There is this logical relationship, that is to say, the process of de-capacity is a long process. There are only two situations in which the industry chain is penetrated. The first is the joint guarantee of local debt enterprises, which has a systematic reaction and leads to a cliff. The second is to be assigned to the mine. We must first see if they are determined to continue to increase their investment significantly and expand the amount in 2017. If they cannot expand, they will continue to fight. The break of this line will take some time to accumulate. How long does it take to accumulate, 1601 may not be able to see, 1605 is not easy to say. For steel, it will have a negative effect on iron ore. If the production capacity is not narrowed, it may form a pessimistic mood. The long days will be more depressed, and most trading opportunities will be more market-oriented. In a pessimistic atmosphere. Concerned about surprises

pressure transmitter is a device that converts pressure into a pneumatic signal or an electric signal for control and remote transmission. Pressure Sensor can convert the physical pressure parameters such as gas and liquid felt by the load cell sensor into a standard electrical signal (such as 4~20mADC, etc.), to supply secondary instruments such as indicating alarms, recorders, regulators, etc. for measurement and indication and process regulation.

Pressure transmitters are used in various industrial automatic control environments, involving water conservancy and hydropower, railway transportation, intelligent buildings, production automatic control, aerospace, military industry, petrochemical, oil wells, electric power, ships, machine tools, pipelines and many other industries.

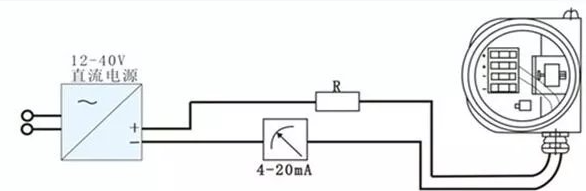

There are two types of pressure transmitters: electric and pneumatic. The uniform output signal of the electric type is a direct current signal such as 0-10mA, 4-20mA or 1-5V. The unified output signal of the pneumatic type is the gas pressure of 20-100Pa.

Pressure transmitters can be divided into force (torque) balance type, capacitive type, inductive type, strain type and frequency type according to different conversion principles.

Our advantageous products are mainly compact pressure transmitters, pressure transmitters with display, differential pressure transmitters, wind pressure transmitters, etc.

The main advantage

1. The pressure transmitter has the characteristics of reliable operation and stable performance

2. Dedicated V/I integrated circuit, less peripheral components, high reliability, simple and easy maintenance, small size, light weight, and extremely convenient installation and debugging;

3. Aluminum alloy die-casting shell, three-terminal isolation, electrostatic spray protection layer, durable;

4. 4-20mA DC two-wire signal transmission, strong anti-interference ability and long transmission distance;

5. LED, LCD, and pointer three kinds of indicator heads, the on-site reading is very convenient. Can be used to measure viscous, crystalline and corrosive media;

6. High accuracy and high stability. In addition to the imported original sensor that has been corrected by laser, the comprehensive temperature drift and nonlinearity of the whole machine within the operating temperature range are finely compensated.

Pressure Transmitter,Pressure Transducer Sensor,Digital Pressure Sensor,Pressure Transmitter 4-20Ma Wuxi Winsun Automation Instrument Co., Ltd , https://www.jswxwinsun.com

Gao Bo: Analysis of the trend of steel market in 2015/2016