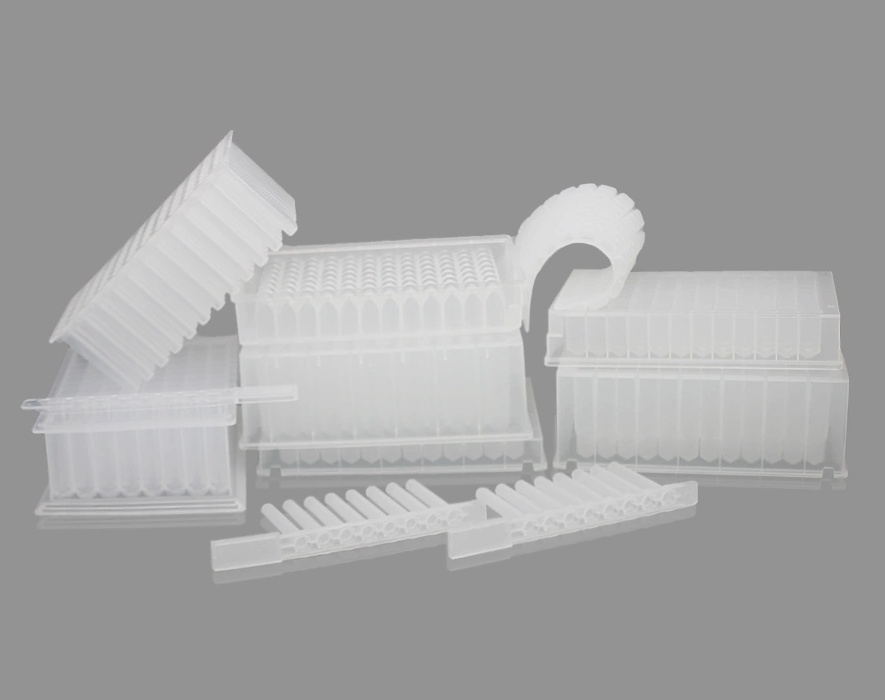

Made of medical grade polypropylene, resistant to alcohols and other mild organic solvents. 96 Deep Well Plate 2 ml,2.2 ml Deep Well Plate,2ml 96 Well Plate,96 Square Well Plate,96 Deep Well Block Yong Yue Medical Technology(Kunshan) Co.,Ltd , https://www.yongyuecultureplate.com

Can provide sterilization, with lid, independent packaging.

Provide 10ml, 4.6ml, 3.5ml, 2.2ml, 1.6ml, 1.0ml, 1.2ml, 0.5ml, Deep-Well Plate and 96 Deep Well Plate.

It can be sealed with a Sealing Film or a silicone cover.

It complies with the international SBS automation standard and is compatible with the international standard DNA to provide equipment.

The magnetic tip comb, which is usually used along with deep well plate, can be divided into 96 magnetic tip comb and 8 Row magnetic tip comb. Both of the comb tips has different dimension to match the different size of the plate well.

The United States metal can market is huge

Both the US packaging market and the metal can market are far ahead of the rest of the world. At present, the size of the global packaging market is more than 400 billion U.S. dollars, and U.S. packaging annual spending is more than 100 billion U.S. dollars, accounting for about a quarter of the world. Metal cans are important packaging products. At present, the annual consumption of metal cans is only 400 billion yuan. The annual consumption of metal cans in the United States is more than 130 billion, accounting for about 1/3 of the world total.

Metal cans have been widely used in the packaging of foods, consumer goods, and industrial products. The annual consumption of metal cans, including food cans, beverage cans, air pressure cans, and general cans in the world, is over 400 billion. Beer and cool Beverage cans consume the most, accounting for more than half of the total, reaching 220 billion. Processing beverage cans accounted for 1/4 of 100 billion, and processed food cans accounted for nearly 20%, approximately 75 billion. Air pressure tanks account for 3%, with 10 billion. General tanks account for 1%, up and down 5 billion.

The shipment of US metal cans is far ahead of other countries in the world. As early as the late 1980s, the use of metal cans in the United States has exceeded 100 billion. In 1987, shipments of cans in the United States were 109.3 billion, which increased to 114.2 billion, 120 billion, 127 billion and 129.4 million in 1988, 1989, 1990, and 1991, and reached more than 130 billion in 1992. Only 13.07 billion were in excess of 130 billion in recent years. For example, during the 10 years between 1993 and 2003, the annual application of metal cans in the United States was no less than 130 billion, and the high year amounted to nearly 140 billion. In 1998 and 1999, they were 139 billion, with the lowest amount used in 1993. The year is also 129 billion. However, after 2000, shipments of US metal cans fell compared to 1998 and 1999. In 2000, they decreased to 136.2 billion. In 2001, they continued to decrease to 135.8 billion. In 2002, they rose slightly to 136.2 billion. In 2003, they again It was reduced to 134.6 billion. Shipments in 2003 decreased by 1.1% from the previous year, a decrease of 3% compared with the highest output in 1999, which is the lowest shipment since 1996, which is equivalent to the 1995 level of 8 years ago.

Beverage metal cans (including beer and soft drink cans) accounted for the largest number of metal cans in the United States, accounting for more than 70% of the total metal cans, such as 73.8% in 1993, 74% in 1998, and 74.1% in 2003. Since 1997, the United States has used more than 100 billion metal beverage cans each year, of which 102.8 billion were in 1998, the highest record in history. In 2001 and 2002, the use of American beer and soft drink cans decreased slightly to 108.0 billion and 100.5 billion, and in 2003 dropped to 99.7 billion under 10 billion. Among them, 68 billion are soft drink cans (having reached 69.4 billion in 1998 - the highest usage in the past 10 years, the same below), and 31.7 billion beer cans (having reached 38.2 billion in 1992).

The consumption of carbonated soft drinks in the United States increased year by year, from 51.2 gallons (1 gallon to 3.785 liters) in 1995 to 52.6 gallons in 1996, 53.7 gallons in 1997, and 1998. 54.8 gallons, 54.6 gallons in 1999 and 55 gallons in 2000 (208 liters). The beverages that the Americans consume more often, in addition to carbonated beverages, are 8.4 gallons (107 liters) of coffee drinks, 24.2 gallons (92 liters) of milk, 22.3 gallons (84 liters) of beer, and bottled water11 3 gallons (43 liters), tea beverages 6.8 gallons (26 liters), fruit juice 6.3 gallons (24 liters), powdered beverages 5 gallons (19 liters), wine 1.9 gallons (7.2 liters), Spirits 1. 2 gallons (4.5 liters). From the perspective of consumption, carbonated beverages also ranked first in the US beverage market, accounting for 30.8% of total consumption, followed by beer, 27.5%, spirits, 15.1%, and milk, 7.6%. Wines accounted for 6.7%, juices 5.7%, coffees 3.5%, bottled water 2.0%, tea drinks 0.5%, and powder drinks 0.4%. There are three main types of soft drink packaging containers in the United States: metal cans, glass bottles, and PET bottles. The consumption of metal cans is very impressive. There were 53.3 billion cans in 1990, 57.4 billion in 1992, and 66.3 billion in 1994, a slight decrease to 64.5 billion in 1996 and 69.4 billion in 1998, 1999 In 2000, it was reduced to 68.94 billion and 67.4 billion respectively, and in 2001 it was 68.1 billion. However, in recent years due to the rapid development of PET bottles, metal canned soft drinks accounted for the proportion of all soft drinks in terms of capacity, showing a declining trend, from 55% in 1991 to 50% in 1995 and 48% in 1998, 1999 The year is 48.3%. The number and capacity of PET bottles are rapidly increasing. In 1990, the number of PET bottles in the United States was 7.6 billion, which was increased from 13.3 billion in 1994 to more than 20 billion in 1997 and 22 billion in 2000 and 2001 respectively. 22.5 billion only. Since the capacity of PET bottles is much larger than that of metal cans and glass bottles, the advantage of PET bottles in terms of capacity is even more obvious, from 34% in 1990 to 51% in 1999. Glass bottles are showing signs of decline, with consumption decreasing sharply from 9.2 billion in 1990 to 4.5 billion in 1994, 1.6 billion in 1996 and 1.4 billion in 2001. The glass bottle capacity ratio also dropped dramatically from 12% in 1990 to 8.7% in 1992, 4.4% in 1994, and 0.7% in 1999. The US glass bottled soft drinks have been minimal.

The American beer production has long been the world's first. However, in the last 10 years, it has decreased from 23.7 billion liters in 1993 to 23.4 billion liters in 1998 and 23.1 billion litres in 2003. The proportion of the world’s total has also dropped from 19.9% ​​in 1993 to 17.6% in 1998 and 15.7% in 2003. In 2002, China's beer production increased by 23.59 million KL, exceeding the United States (23.46 million KL) and becoming the world's largest beer producer. In 2003 and 2004, China's beer production was 25.1 million KL and 29.1 million KL, both higher than the United States. Metal cans play an important role in American beer packaging containers. The number of metal cans used in beer packaging reached 38.2 billion in 1992 and then declined year by year. It was 36.8 billion, 346 in 1994, 1996, 1998, and 2000 respectively. Billion, 33,400 million and 32.9 billion, and 31.7 billion in 2003. Glass bottled beer has gradually increased in recent years, from 12.8 billion in 1992 alone to 16.7 billion in 1996, 18.7 billion in 1998, and 18.4 billion in 2000, and 18.8 billion in 2001. The use of plastic (PET) bottles in packaging beer has only recently emerged. In 1999, the amount was only 50 million, but in 2000 it increased by 200% to 150 million, and in 2001 it has doubled. Increased to 300 million. Metal cans still have a high popularity in beer packaging. In 2002, the proportion of metal cans in all containers for beer packaging in the United States accounted for more than half (54%). It is expected that with the continuous increase in the use of glass containers in the next three years, the proportion of metal cans will decrease by 5.3% to 50.7%.

The amount of food cans has exceeded 30 billion in recent years. In 1997, it was 32 billion, which was increased to 32.3 billion in 1999, but it was reduced to 30.8 billion in 2001, and it was further reduced to 30.5 billion in 2003, a decrease of 2.5% from the previous year. The proportion of the total usage is more than 20%, such as 23% in 1997 and 1999, 23% in 2002, and 22.7% in 2003. The number of vegetables and vegetable juice cans was the largest, reaching 9.8 billion in 1999. In 2002, it increased to 10.4 billion over 10 billion, and in 2003 it was 10.6 billion. The number of pet food cans shipped reached 8.2 billion in 2000 and was reduced to 7.2 billion and 6.6 billion in 2002 and 2003, respectively. Shipments of broth pots were also relatively large, amounting to 6.2 billion in 1997, decreasing to 5.6 billion in 2001 and 4.7 billion in 2003. Dairy cans were 2.2 billion in 2003, a decrease of 10% from the previous year. There were 1.96 billion fruit cans (a total of 2.6 billion in 1997), 1.96 million livestock and poultry cans (a 3.4% increase over the previous year), and 1.2 billion aquatic products cans (amounting to 2 billion in 1995). General tank shipments in 2003 were 4.36 billion. Among them, 3.1 billion aerosol cans.

Like other countries in the world, the status of plastic containers in US packaging containers is also increasingly important. The consumption of plastic packaging containers in the United States continues to grow for many years. In 1998, the consumption of plastic containers in the United States was 4.5 million tons, which increased to 5.55 million tons in 2003 and will increase to 6.64 million tons in 2008, with an average annual increase of 4%. Plastic bottle consumption is the largest among various plastic containers, which was 4.26 million tons in 2003, a 26% increase over 1998, and 5.1 million tons by 2008. The consumption of plastic cans and bowls and cups was 520,000 tons and 410,000 tons respectively in 2003. The consumption of plastic containers for beverages in the United States was only 21 billion in 1992 and increased to 47 billion in 2001, reaching about 50 billion in 2002, an increase of 1.5 times in 10 years. In 2002, among the fruit juices and vegetable drinks produced in the United States, plastic containers accounted for 30% of all containers in quantity, and they ranked first in the use of various containers. It is expected that this proportion will increase to 34.8% by 2007. Plastics accounted for 2nd place in containers for carbonated drinks and milk. In 2002, plastic containers accounted for 28.5% of all containers of carbonated beverages in the United States, which was only less than that of metal cans (64.9%). 40.1% of milk packaging containers are plastic containers, which are lower than paper containers. However, the progress of plastic containers in beer packaging is still quite slow. In 2002, plastic containers accounted for only 0.3% of all containers used in beer in the United States. By the year of 2007, they only increased to 0.5%.

World metal can consumption

Consumption

use

Quantity

(hundred million)

Ratio

(%)

Beer and refreshing beverage cans

2200

54

Processing beverage cans

1,000

twenty four

Processed food cans

750

18

Air pressure tank

100

3

General cans

50

1

Total

4100

100

US metal cans shipments

Unit - Billion

Year

category

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

Beverage cans

976

1031

977

991

1007

1028

1023

1003

1008

1005

997

Food cans

305

309

303

320

320

318

323

316

308

313

305

Other cans

41

42

43

44

44

44

44

44

42

44

44

total

1322

1382

1343

1355

1371

1390

1390

1363

1358

1362

1346

US metal cans consumption

Unit - Millions

Year

category

1997

1998

1999

2000

2001

2002

2003 (growth %)

Drink

beer

Soft drinks

100680

102792

102271

100277

100750

100477

99747

-0.7

34202

33394

33351

32896

32736

32211

31720

-1.5

66479

69398

68920

67381

68014

68266

68027

-0.4

Food products

Children's food

coffee

Dairy products

Fruit Juice Drink

Meat chicken

Aquatic products

Vegetable juice

Broth, etc.

pet food

31990

31784

32337

31561

30819

31281

30486

-2.5

1141

793

782

585

489

821

810

-1.3

529

620

632

432

433

512

471

-8.0

1278

1616

1545

1838

2295

2436

2185

-10.3

2560

2502

2303

2098

2037

2081

1957

-6.0

1681

1661

1822

1651

1798

1894

1958

3.4

1899

1685

1630

1631

1509

1189

1215

2.2

8983

9223

9805

9545

8685

10350

10591

2.3

6163

6093

5728

5567

5579

4810

4732

-1.6

7789

7593

8090

8214

7994

7188

6570

-8.6

General cans

Aerosol

Other non-food products

4370

4404

4406

4356

4232

4353

4360

0.2

2922

2996

3066

3002

2969

3083

3435

1.7

1453

1408

1340

1354

1263

1270

1226

-3.5

total

137040

138978

139014

136194

135801

136110

134593

-1.1

Proportion of several beverage packaging containers in the United States (2002)

Natural fruit juice

milk

Carbonated drinks

beer

plastic container

30.1%

40.1%

28.5%

0.3%

Metal container

16.0%

2.4%

64.9%

54.1%

glass container

18.7%

1.1%

6.6%

45.6%

Paper containers

17.6%

53.3%

-

-

Flexible packaging container

14.8%

2.8%

-

-

Aseptic beverage tray

2.8%

0.2%

-

-

US soft drink packaging container shipments

Unit - Billion

Year

category

1992

1994

1996

1998

1999

2000

2001

glass container

78

45

16

14

14

14

14

Metal container

574

663

645

694

689

674

681

plastic container

98

133

168

206

214

220

225

Total

750

841

829

914

918

907

920

US beer packaging container shipments

Unit - Billion

Year

category

1992

1994

1996

1998

1999

2000

2001

glass container

128

151

167

177

182

184

188

Metal container

382

368

346

334

334

329

332

plastic container

-

-

-

-

0.5

1.5

30

Total

510

519

513

511

516

513

523