In May, the overall decline in building materials was significant in East China and Central China. Iron ore ** problem fermentation, real estate investment growth rate decline and other negative continued, 51 after the high hopes for the market to become a bubble, and in the case of raw materials fell more than the case of the material, the steel production enthusiasm unabated, a price Falling again and again, part of the new low has been refreshed during the year. June high temperature and rain, inhibit the release of effective demand, and the raw material is expected to remain weak next month, the steel mills will not expand the production, repair range, production is still difficult to significantly decline, and supply and demand imbalance is still a larger factor to suppress the market. It is recommended that downstream steel enterprises purchase on demand; traders make up the stock according to the amount of resources, and ship on rallies, and the operation of wet storage is the main operation; intermediate traders operate in short cycles. Exit Sign,Exit Light,Exit Signage,Exit Sign With Lights NINGBO JIMING ELECTRIC APPLIANCE CO., LTD. , https://www.feituosafety.com

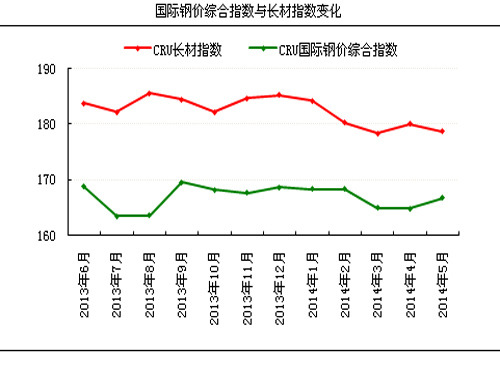

I. Overview of the international market In May, the international steel market was stable and weak. The CRU International Steel Price Index stood at 165.11, down 0.5% from the previous month and 2.1% from the same period of last year. The CRU long steel index was 178.67. The overall European market is stable, scrap prices stabilize, steel mills lack price increases, downstream attitudes are cautious, and more are purchased on demand. We expect to maintain weaker stability next month; the US market remains stable, downstream demand is satisfactory, and there is sufficient supply of resources. It is expected to stabilize next month. Operation; Asian market has not been changed. Affected by the weakening of wire rod market in Europe and the United States, China's wire rod quotation is the lowest point since April 2009. The capital flow is tight, and it is not optimistic about the market outlook. It is expected to remain sluggish next month. In summary, the international steel market is expected to remain stable and weak next month.

Second, the domestic market dynamics 1. Changes in the domestic market This month, domestic building materials all the way down, the current market price in most regions has fallen the lowest point in recent years. Affected by the unfavorable news of the China Banking Regulatory Commission’s rapid investigation of iron ore** trade and poor real estate industry data, the post-May Day steel market was pessimistic, steel traders accelerated their willingness to ship, causing local market prices to loosen. Weak and sluggish; in the process of falling steel prices, the downstream mining purchasing and buying habits gradually fermented, coupled with the suppression of terminal demand due to rain weather, the overall turnover in the month performed poorly, prompting the decline to continue until late; near the end of the month; At that time, the price had forced the low point in recent years, and business losses have caused concern. In addition, some steel mills have affected the market, so that the market has stabilized and stabilized, and local markets have rebounded slightly under the rebound of the “short-lived†trend. In June, when the temperature is high and it is raining, the effective demand of the steel market will weaken, and the crude steel production has not yet dropped significantly. At present, the prospect of market rebound is still small.

The profit space has narrowed slightly this month. According to the cost model, as of May 29, domestic small and medium steel enterprises 20mm three-tier rebar profitability of negative 311 yuan / ton, compared with the end of last month (negative 242) negative growth of 69 yuan / ton; 6.5mm high-line profitability for Negative 166 yuan / ton, compared with the previous month (negative 101) negative growth of 65 yuan / ton. Although the current domestic steel prices have fallen to a historically low level, there is limited downside, but the industry's funding problems are still fermenting, the real estate market has shifted into deeper adjustments, and the ore price has broken down. Coupled with the traditional off-season of the steel market, the trend is still not optimistic next month. With respect to raw materials, steel mills have high production capacity, and they still have rigid demand for raw materials. However, with the gradual reduction of profits, steel mills are extremely cautious in purchasing, and the maintenance and production of steel mills will gradually increase in the later period, and raw materials are expected to fall. The building materials research team expects that the profitability of small and medium-sized steel enterprises will continue to grow negatively next month this month.

2. Production Capacity and Production Analysis According to the latest statistics from the National Bureau of Statistics, China's crude steel production in April totaled 68.838 million tons, an increase of 2.2% year-on-year; April steel output was 92.49 million tons, an increase of 5.4% year-on-year. In the month, the average daily output of crude steel in the country was 2,294,700 tons, an increase of 1.26% from the average daily output of the previous month. This year, it showed a monthly rising trend. According to data from the China Iron and Steel Association, in the first half of May, the daily output of key steelmakers was 1, 834,1 million tons, which was a record high and was 1.6% higher than that of the previous ten days. It continued to rise in the 4th consecutive year. It is expected that the country's crude steel output will continue to rise in the later period, mainly because domestic steel mills still have profitable space for production and the steel production enthusiasm will not decrease. Therefore, the overall domestic steel supply pressure is expected to continue to increase in the later period.

3. Changes in the total inventory of spirals In May, the total inventory of domestic building materials continued to drop. As of May 23, total inventory amounted to approximately 8.5254 million tons, an overall decrease of 15.64% compared with the previous month, a decrease of 16.54% last month, a year-on-year decrease of 17.95%; of which the total amount of thread was approximately 6,988,900 tons, a decrease of 14.59% compared with the previous month, and was reduced last month. 14.53%, a year-on-year decrease of 13.97%; the total amount of wire rods was approximately 1.5365 million tons, a decrease of 20.07% from the previous month, a decrease of 24.15% last month and a decrease of 32.21% year-on-year. According to the latest data from the China Iron and Steel Association, the daily output of crude steel of key enterprises in the middle of May was 1.905 million tons, a reduction of 23,600 tons, and a decrease of 1.29% compared with the previous period. Although inventory continues to decline, but with the off-season approaching, and crude steel production remains high. Considering comprehensively, the inventory is expected to decline in June, but the decline has slowed down compared to the same period of last year.

4. Imports and Exports Analysis (1) Import Analysis In April 2014, China's steel rod imports fell in line with that of the previous period, and import of wire rods increased year-on-year and slightly decreased month-on-month. The import of wire rods was 61,900 tons, which was a year-on-year increase of 57.93% and a decrease of 4.82% compared with the previous period; the imports of rebars were approximately 0.54 million tons, a year-on-year decrease of 38.71% and a month-on-month decrease of 15.54%. In April, the total import volume of wire coils was approximately 67,300 tons, which was a year-on-year increase of 40.26% and a month-on-month decrease of 5.77%. In May, the domestic building materials market was sluggish, mainly because the phenomenon of overcapacity did not change. However, with the partial urban real estate policy “released "The good news gathered at the end of the month. Some cities have seen a pull-up. The demand side is expected to improve. Imports are expected to change little in May.

(2) Export Analysis In April 2014, China's steel bars exports continued to fall year-on-year and continued to increase year-on-year, with wire rod exports increasing at the same pace as in the previous quarter; among them, rebar exports were 18,800 tons, which was a decrease of 38.3% year-on-year and an increase of 10.17% month on month; wire exports were 94.11. Ten thousand tons, up 24.87% and 0.99% respectively over the previous quarter. In April, the total export volume of wire coils was approximately 959,900 tons, which was an increase of 22.79% and 1.13% respectively from the previous quarter; in May, the international steel market was weakly operating. The sentiment was negative in the European market, and the resource prices in southern Europe were lower, and the downstream demand was more procured. The United States market supply and demand balance, steel mills may tighten supply, causing prices to rise. Considering comprehensively, domestic demand is limited this month, but crude steel production is still at a high level and steel mills are actively seeking export orders. It is expected that exports will increase slightly in May.

5. Analysis of downstream demand (1) Infrastructure construction In April, railways, highways, and waterways completed a total of 150.1 billion yuan in fixed asset investment, which was a year-on-year decline of 1.2%, and the growth rate continued to decline by 6.2% from March. Among them, the investment in railway construction completed 36.5 billion yuan, a drop of 16.9%; highway construction completed an investment of 101 billion yuan, an increase of 5.9%; waterway construction completed an investment of 11.7 billion yuan, a decrease of 1.8%. In March and April, railway infrastructure investment dropped by 6.4% and 0.6% respectively year-on-year. It is believed that since April the country’s “micro-stimulus†in the field of infrastructure has continued to increase, and funds have been tightly constraining the intensity of railway and other transportation construction. In the later period, market funds have been specifically balanced or loosened, but it is difficult to relax significantly. It is expected that in the short term, the growth of infrastructure investment will continue or remain weak, and the demand for infrastructure steel, such as spirals and pipe profiles, will continue to pick up or continue to be seasonally weaker.

(2) The latest data from the National Bureau of Statistics of Real Estate shows that compared with January-February, from January to April, the national investment in real estate development increased nominally by 16.4% year-on-year, and the growth rate dropped by 0.4%; the funds for real estate development enterprises increased by 4.5% year-on-year , The growth rate dropped by 2.1 percentage points; the sales area of ​​commercial housing fell by 6.9% year-on-year, a decrease of 3.1 percentage points; the housing construction area of ​​real estate development enterprises increased by 12.8% year-on-year, and the growth rate dropped by 1.4 percentage points; the area of ​​new housing starts fell by 22.1%, and the decline was Narrow by 3.1 percentage points; housing completion area decreased by 0.3%, and the decrease narrowed by 4.6 percentage points; real estate development companies’ land purchase area decreased by 7.9% year-on-year, a decrease of 5.6 percentage points; land transaction price increased by 9.6%, and the growth rate dropped by 1.8 percentage points; At the end of April, the area for sale of commercial housing increased by 23.6% year-on-year, and the growth rate increased by 0.7 percentage points to 526.52 million square meters. In April, the downward pressure on the real estate industry further increased. In May, the property market was mixed, sales fell, stocks rose, capital shortages, land flow, etc. The central bank’s efforts to support first-home mortgages, local deregulation, and other restrictions were limited. The real estate investment in the quarter will be weaker than in previous years. In the short-term, new housing starts and other projects are still not optimistic. The demand for related building materials is weak.

In May, the policy of the steel mills will be adjusted downwards. This month, when the steel market entered the off-season, downstream demand was unlikely to perform well, and crude steel production was still at a high level. As a result, business expectations for the market continued to weaken. In addition, the spiral continued to hit and fell, and the steel price trend showed during the month. All the way down, so the steel mills had to follow suit lower to prevent inventory increase and guarantee order rate. At present, the market prices in many cities have fallen below the lows in recent years, and the market has stopped showing some sentiment. Among them, steel mills in north and north China are experiencing market prices. However, in June, hot and rainy weather frequently occurs, and the atmosphere of the steel market is difficult to improve. Steel mill policy will continue to decline next month.

Third, ** market analysis 1. Technical analysis As of May 30, the main screw 1410 contract opened 3220, this month, the highest 3249, the lowest 3047, closing 3056, the closing price fell 171 from the previous month, a decrease of 5.30%, turnover 41275936 hand, holding 1912636 hands at the end of the month.

From the technical analysis point of view, the K line of the 10th contract month formed barefoot and long yin; from the K-line, the K-line of the week K was 5 consecutive negative, the trend indicator KDJ low diverged downward, and the leading indicator MACD was operating in the green column range. Column enlargement; From the K-line point of view, the Japanese K line rebounded slightly after the end of the month and then fell again. The trend indicator KDJ K line below the D line to form the Sicha, the leading indicator MACD is in the red column interval, but the red column significantly narrowed.

2. The outlook for the next month The expected period of the main screw 1410 fell after the first stable this month, the interval 3000-3100, the latter half of the decline may have eased. Shortly before the next round of appropriate participation, long wait and see, late seeing machine admission. The total positions of long and short positions are controlled within 10%, and the daily futures operation recommendations are specifically noted.

Fourth, the trend forecast for next month From the major factors affecting the trend of the building materials market, the next month’s air force’s strength is relatively heavy: real estate investment is expected to be weaker than in previous years, and “micro-stimulus†in the infrastructure sector is overridden by funds. June high temperature and rain, resulting in persistently low demand for effective demand; port iron ore inventory high, coke coal price increase meeting failed, raw materials trend or weakness next month, steel mills cost decline, production is still difficult to drop significantly; traditional sales pressure From the agents gradually transferred to the steel mills, the price adjustment policies of steel mills may still fall steadily; macro “good fortune†is intensively introduced, but the effect is microscopic. Therefore, the building materials research team expects the market volatility to weaken next month.

The decline in steel output prices find support