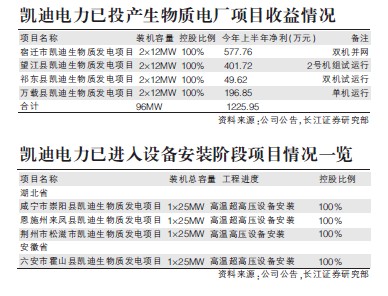

By the end of 2011, the company's biomass power generation and construction projects will exceed 25 Changjiang Securities Recently we have done a research report on Wuhan Kaidi Power (000939, Shares) Co., Ltd. (Kaidi Power, 000939). Business transformation has started Kaidi Power's controlling shareholder, Wuhan Kaidi Holding Investment Co., Ltd. (hereinafter referred to as Kaidi Holdings), has entered the biomass power generation market since 2004. (Editor's note: Biomass power generation is the use of biomass for biomass power generation and is renewable. A type of energy power generation has carried out a large number of research work on green energy projects in more than 1,500 counties and cities in China, and signed cooperation framework agreements on biomass raw material supply with 266 counties and cities, and got the highest quality project reserves. At present, 111 biomass energy project companies have been established, of which 23 have been sold to listed companies. A total of 66 projects have been approved to carry out pre-project work, 32 projects have been approved, and 13 mature projects have been completed. By the end of 2011, the total number of projects with conditions for commencement or construction and completion will be close to 100. We believe that Katie Power may continue to acquire from Kaidi Holdings its projects under construction or completion of power generation in the future. There will still be incremental projects with quality projects in the future. In 2010, Katie Power entered the first year of full-scale biomass power generation. Following the acquisition of 9 biomass power generation projects from controlling shareholders in November 2009, the company increased its investment in bio-power plant projects in 2010 and acquired it again. 14 biomass power plant projects. At present, Kaidi Power Suqian Power Plant, Wanwan Power Plant, Wangjiang Power Plant and Jidong Power Plant have begun to contribute profits. The total net profit for the first half of this year was 12.25 million yuan. In the future, the company will work with the group to develop or acquire new biomass power plant projects. In 2011, four projects in Hubei Chongyang, Laifeng, Songzi and Anhui Huoshan are expected to be put into operation within the year. In addition, three projects in Anhui Nanling, Huainan and Chongqing Fengdu are expected to be put into production at the beginning of next year. Based on this calculation, the company will be put into operation by the end of 2011. Biomass power plant projects will reach 8 (without considering newly acquired power plants). With the rapid transformation of Kaidi Power, the total number of projects under construction and completion of biomass power plants at the end of 2011 may reach more than 25, of which more than 10 will be built and built. Kaidi's power business includes: sales of raw coal, off-grid and power contracting projects, environmental power generation, biomass power generation and cement business. At present, Kaidi Power is accelerating its transformation into a biomass industry. Future biomass power generation projects, biomass fuels and related industrial chain products will become the main business of the company. The existing raw coal sales and off-shore power projects will continue to support the company's performance in the short term, providing time and support for the transformation of biomass. At the same time, the environmental protection power generation business will try to transform biomass power generation through technological transformation, so as to gradually achieve losses. In addition, the profitability of the company's biomass power generation project has been initially verified, and the projects to be put into production in the follow-up will adopt the high temperature and ultra-high pressure circulating fluidized bed, which will have more prominent profitability. According to the power plant's annual KPI (Key Performance Indicators) assessment of 7,000 hours and 14% of the electricity rate, a simple calculation, in the absence of CDM (Clean Development Mechanism) revenue, a single power plant in the normal operation of the year including the return of VAT return on net profit It is RMB 27 million (net profit of approximately RMB 19 million if VAT refund is not included). Technical advantage into "moat" In addition, we analyzed the technical advantages into Katie Power's "Moat". As far as the company itself is concerned, we believe that its technical superiority and fuel cost control measures are more important core competitiveness of the company. The Kaidi Power Biomass Power Plant uses the world's leading, proprietary patented high-temperature ultra-high pressure circulating fluidized bed boiler combustion technology. In addition, the company also owns more than 100 technical patents including unit combined cycle technology, ultra-high temperature and high pressure technology, and gasification and liquefaction technology. Boiler technology is the largest competitive advantage of the company's biomass power generation project. Its design is completely completed by the company and its controlling shareholder. The turbines of future power generation projects will also import imported equipment to ensure continuous and stable operation throughout the year. The technical advantages embodied in the current medium-temperature medium-pressure boiler system are not yet obvious, but are still significantly higher than the industry average. Kaidi Power will further develop large-scale biomass gasification power generation systems. The future technology direction is integrated gasification combined cycles (IGCC) technology. Atmospheric biomass IGCC system can achieve the following technical indicators: output power of 7000-30000KW, the system efficiency of 35% to 40%, the operation can be long-term continuous non-stop, compared to the current system efficiency increased 17% to 30%. In addition, Kaidi Power adopts a unique business model for the acquisition of fuels, using industrial workers to directly purchase fuel, signing long-term fuel supply agreements with processing plants, and establishing energy forests to increase self-sufficiency rates. The company's follow-up power plant projects will in principle be equipped with at least 6 Million mu of energy forest, heat value reached more than 3200 kcal. The cost of fuel is significantly lower than that of its peers. Currently, the average cost is about 267 yuan/ton, while that of other biomass power plants is basically above 350 yuan/ton. Blu-ray environmental power plant will turn losses We believe that as the transitional biomass industry requires a large amount of capital investment and cooperates with the national industrial policy, after Kaidi Power proposes a transition to the biomass industry, on the one hand, controlling shareholders and companies have done a lot of work in the direction of the established strategic transformation; on the other hand, When the company's biomass industry has not yet been able to support most of its performance, coal and overseas contracted power projects will support most of the results. The Kaidi Power coal business mainly consists of Yanghe Coal, Wanyi Coal and Jiading Coal, among which the profit comes from Yanghe Coal, while the coal mines of Wanyi Coal and Jiading Coal are in accordance with the requirements during the technical transformation of coal mines. Did not contribute profit. We expect Kaidi Power to increase its coal safety production investment in the second half of the year, and coal mining costs may increase in the second half of the year. According to the "Notice on Further Strengthening the Safety Production of Enterprises" issued by the State Council, Kaidi Power will install underground mine safety monitoring and control systems, downhole personnel positioning systems, underground emergency hedging systems and other downhole safety hedging technology equipment, which will increase Yanghe Coal's coal production costs. It is also worth noting that the tendering consortium formed by Kaidi Power and Kaidi Engineering Co., Ltd. and Germany's WULLF Co., Ltd. has signed a general contract construction contract with the Vietnam National Coal Mining Industry Group for the 2x220MW thermal power plant project in the Chaoyang Stream in Vietnam. Kaidi Power is responsible for consulting, equipment selection and complete sets, commissioning, operation management and personnel training. The total amount of sub-items is adjusted to 278.55 billion US dollars, the company accounts for 65%, the construction period is 3 years, and the estimated annual net profit is 90 million. More than yuan; the Vietnam River Creek project in 2010 has progressed smoothly. By the end of 2010, 128 equipment order contracts and five consulting agreements have been signed. We expect that with the acceleration of the construction of thermal power plants in Vietnam itself, the continuous development of the Vietnamese market will bring some benefits to the company in the near future. In addition, the loss of Katie Power's Blu-ray environmental power plant in 2010 was about 53 million yuan; in the first half of 2011, due to the high price of thermal coal, the Blu-ray power plant is still facing losses. In the second half of the year, the company plans to retrofit the No. 1 unit of the Blu-ray Power Plant through biomass energy-saving technological transformation to reduce the dependence of power generation fuels on thermal coal and reduce the cost of power generation. Due to the abundant agricultural waste in the area where the Blu-ray power plant is located, and the large unit size (equivalent to 9 conventional biomass units), the unit's transformation cost is lower than that of the newly-built power plant project, and the management personnel have rich experience. We expect that the power plant will turn deficits once it is completed. In the second half of the year, the company will promote the technical renovation work and project application of Unit 1. We believe that in the adjustment of China's economic structure, energy structure adjustment is particularly important. The development and utilization of biomass energy is an important part of the future energy strategy. Kaidi Electric Power, as the leading technology leader with leading advantages, will gradually Show its relative advantage. Kaidi Power is a benchmarking company and standard maker in the biomass power generation industry. It has obvious advantages in terms of technology and cost, and the profitability of projects currently put into production has been initially verified. In the future, as the listed company's projects are gradually put into production and the holding company's mature power plants are further injected, the company's performance will grow rapidly. We estimate that EPS (per share) of Kaidi Power after deducting non-recurring gains and losses from 2011 to 2012 is 0.305 yuan and 0.551 yuan respectively, corresponding to PE of 39.31 times and 21.76 times respectively. We are optimistic about the company's broad prospects for the development of biomass energy. And give it a "recommended" investment rating.

Kaidi Power Biomass Power Generation will become the main business